July 20th, 2024

What Is Regression Analysis in Statistics?

By Josephine Santos · 9 min read

In a data-driven world, statistical analysis is crucial for making new discoveries and data-driven decisions. You’ll find various statistical methods in this critical field, but one of the most important (and commonly used) is regression analysis.

But what does regression analysis in statistics entail, and how can you perform it? That’s precisely what you’ll learn in this guide.

Defining Regression Analysis

Simply put, regression analysis deals with the relationship between two or more variables. The variables in question are known as the dependent variable and the independent variable.

There’s only one dependent variable, and it’s the value you’re trying to understand or predict. As for independent variables, there can be one or more of those. But whether there are one or five independent variables, they share the same characteristics – they are the factor(s) that might influence the dependent variable.

From this, you can probably guess the primary goal of regression analysis. This method aims to understand whether – and how – the dependent variable will change as the independent variable(s) change.

But this isn’t the only goal of regression analysis. This method is also used to make predictions on the future values of the dependent variable. This part is what makes regression analysis a powerful tool for making informed decisions across multiple industries, from finance to healthcare.

Types of Regression Analysis

As often happens in data analysis, there’s more than one type of regression analysis. Here’s a brief overview of the most common among these types.

Simple Linear Regression

The simplest regression analysis type – simple linear regression – is used to understand the relationship between two variables through a straight line. In other words, the goal is to find the best-fitting straight line that predicts one variable based on the other.

For instance, simple linear regression can be used to predict the price of a house based on its size since the latter variable is often a strong predictor of the former.

Example simple linear regression that shows the relationship between house size and price. Created in seconds with Julius AI

Multiple Linear Regression

Multiple regression analysis extends the simple linear regression model to include multiple independent variables for one dependent variable. In the example above, additional independent variables might be the location and the age of the house on the market.

Logistic Regression

You’ll need logistic regression if your dependent variable has only two possible outcomes (e.g., yes or no, success or failure). For instance, logistic regression can be used to determine whether a loan applicant will default on a loan.

Polynomial Regression

Polynomial regression is reserved for cases when there’s no regression line (i.e., linear relationship) between the two variables. Instead, this relationship follows a polynomial curve, a curved line that can better fit the data points. Thanks to this, polynomial regression can model more complex relationships in data, such as the population growth rate.

Non-linear Regression

In non-linear regression, the relationship between the independent and dependent variables can take virtually any form. Besides a straight line or polynomial curve, of course. You’ll see non-linear regression used in situations where the rate of change isn’t constant, such as the spread of infectious diseases in epidemiology.

What Is the Importance of Regression Analysis?

As mentioned, regression analysis is one of the most important methods in statistical analysis. But why? Here are just a few areas where this statistical model is crucial.

Predictive Modeling

Businesses are always looking to forecast future outcomes. By looking into historical data, regression analysis can help them do just that. The result? These businesses can make informed decisions about resource allocations, inventory management, and product pricing, among other things.

Identifying Key Drivers

Key drivers are the leading factors affecting performance. With regression analysis, companies can establish which factors have the most significant impact on their outcomes. For instance – which marketing channel facilitates the most sales?

Risk Assessment

Businesses are no strangers to risks. Market changes, supply chain disruptions, and financial fluctuations are just some of them. Regression analysis can be a lifesaver in this regard, as it can show how a change in one of these risk-prone areas can affect the company’s performance. This allows the business to take proactive measures to mitigate these risks.

Performance Evaluation

Regression analysis can also do wonders for evaluating the performance of various strategies or initiatives. By analyzing the relationship between inputs (e.g., marketing spend and product features) and outputs (e.g., sales and customer satisfaction), this method helps businesses determine which strategies are the most effective and which call for some adjustments.

Market Research

Regression analysis can inspect how variables like pricing, advertising, and product features impact consumer behavior and purchase decisions. Then, businesses can use these findings to tailor their product offerings and marketing efforts to better meet the needs of their customers.

How to Perform Regression Analysis

The exact regression analysis process will depend on the regression model you choose. But generally speaking, these are the steps you’ll go through:

- Step 1 – Establish a comprehensive data set.

- Step 2 – Prepare the data for analysis (e.g., clean it).

- Step 3 – Define the independent and dependent variables.

- Step 4 – Choose the best regression model.

- Step 5 – Analyze the data using the chosen regression model.

- Step 6 – Interpret the results.

Outlined in this way, the regression analysis process appears rather simple. But the truth is that the formulas needed for regression analysis are far from simple. The same goes for interpreting the findings.

That’s why you might benefit from using an AI-powered statistical analysis software tool like Julius AI to perform this analysis for you.

Examples of Regression Analysis by Industry

As mentioned, regression analysis is widely used across various industries. Some have already been mentioned in this guide, such as real estate and finance. But here’s a more comprehensive overview (and examples) of different regression analyses used by industry:

- Finance: Uncovering the relationship between the company’s stock prices and quarterly earnings.

- Healthcare: Estimating whether a patient will develop a specific disease (e.g., diabetes).

- Biology: Modeling complex biological processes, such as enzyme kinetics.

- Marketing: Analyzing the impact of pricing strategies on market share.

- Retail: Forecasting sales based on promotional activities.

- Education: Predicting graduation rates based on school funding levels.

- Environmental science: Showcasing the impact of pollution levels on public health.

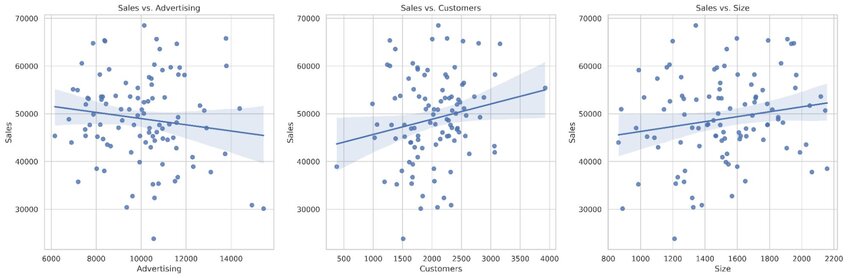

Regression analysis example in the retail industry investigating sales vs. advertising, sales vs. customers, and sales vs. store size. Created in seconds with Julius AI

Effortlessly Utilize Regression Analysis with Julius AI

There’s no doubt about it – regression analysis is a powerful tool that can help make informed decisions across multiple industries.

But unfortunately, not everyone is skilled enough to wield this tool. The good news? With Julius AI, you don’t need any skills. With just the data set and a simple prompt, you can perform regression analysis like a pro.